Summarized Key Points

- Stripe Atlas helps non-US founders incorporate a US company in Delaware, get a US tax ID, and set up payment processing.

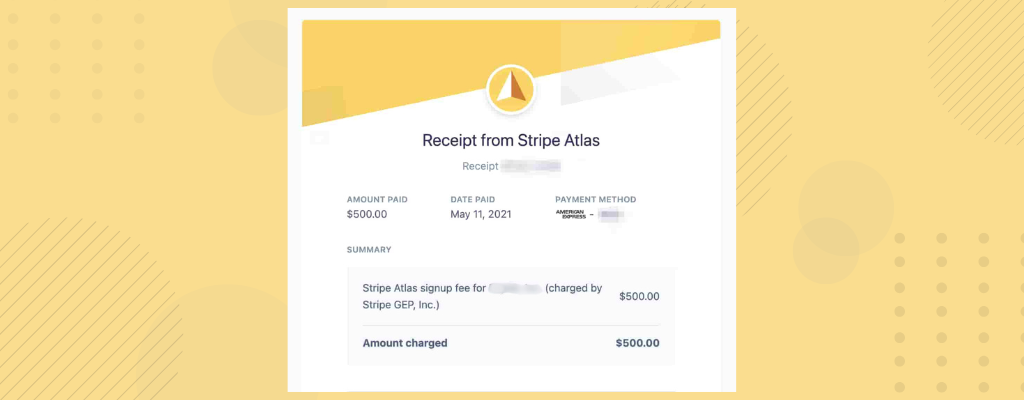

- It costs a one-time fee of $500, with an additional $100/year for registered agent services after the first year.

- Pros include ease of use, time savings, and access to the US market; cons include potential tax and legal risks.

- User experiences vary, with some praising the process and others reporting issues like account migration and high banking fees.

- Surprising detail: It’s only for Delaware incorporation, which may not suit all businesses.

What is Stripe Atlas?

Stripe Atlas is a service by Stripe, a payment processing company, designed for non-US founders to easily incorporate a US-based company in Delaware. It helps you get a US tax ID (EIN), issue founder equity, and set up to accept payments through Stripe, all without needing to be physically present in the US.

How Does It Work?

The process is straightforward:

- Sign up and provide company details.

- Sign legal documents via DocuSign.

- Stripe Atlas files the paperwork with Delaware.

- Obtain an EIN from the IRS.

- Set up a US business bank account and start accepting payments.

It typically takes a few days, making it faster than traditional methods.

Pros and Cons

Pros:

- User-friendly and saves time by handling paperwork.

- Cost-effective at $500 initially, compared to hiring lawyers.

- Opens access to the US market and payment processing in over 100 currencies.

Cons:

- You’ll face US tax laws, which can be complex and lead to double taxation for non-residents.

- Legal risks are higher due to potential lawsuits in the US.

- Limited to Delaware, which may not be ideal for all businesses.

- Some users report issues with migrating existing Stripe accounts and high banking fees, especially with Silicon Valley Bank (SVB).

User Experiences

Reviews are mixed:

- Positive: Users like the smooth process and world-class support, with some saving thousands via AWS credits (Rapidr.io Blog).

- Negative: Some regret using it due to migration hassles and SVB’s $25/month fee with a $25,000 minimum balance (Hacker News Post).

Is It Worth It?

Stripe Atlas is great if you want a quick, easy way to start a US company and are okay with Delaware incorporation. But consider tax implications and legal risks, especially if you’re not in a tax treaty country. Alternatives like Incfile or ZenBusiness might be better if you need more flexibility or lower costs.

Comprehensive Review of Stripe Atlas: My Detailed Experience as a Non-US Resident Founder

Introduction

If like me, you’re a non-US resident entrepreneur looking to launch a US-based business, you’ve likely come across Stripe Atlas. But what is it, and is it the right fit for your startup?

Stripe Atlas, offered by the payment processing giant Stripe, is a service designed to simplify the incorporation process for non-US founders, allowing you to establish a legal entity in Delaware, obtain a US tax ID (EIN), issue founder equity, and set up payment processing—all from anywhere in the world.

This review, based on my own experience, dives deep into its features, pros, cons, user experiences, and alternatives to help you decide if it’s worth the investment.

Background and Purpose

Stripe Atlas was launched to address the challenges faced by international entrepreneurs who want to tap into the US market but are deterred by complex legal and tax requirements.

With over 60,000 startups incorporated through Atlas and founders from more than 140 countries, it’s clear this service has gained traction. It’s particularly suited for tech startups, e-commerce businesses, and those seeking venture capital, but is it the best choice for everyone?

How Stripe Atlas Works: Step-by-Step Process

From my experience, the setup process is very user-friendly and efficient, typically taking just a few days. Here’s how it unfolds:

- Sign Up and Provide Information: Create a Stripe account and fill out the Atlas form with details about your company and co-founders.

- Generate and Sign Legal Documents: Atlas generates necessary legal documents, which you sign via DocuSign, ensuring compliance with Delaware laws.

- File Paperwork: Atlas submits the incorporation paperwork to Delaware on your behalf, handling the bureaucratic legwork.

- Obtain EIN: Atlas assists in obtaining an Employer Identification Number (EIN) from the IRS, crucial for tax purposes and opening a bank account. Note that during peak times, like the COVID-19 backlog in 2020, this step took up to 4 months for some users (Rapidr.io Blog).

- Set Up Banking and Payments: Post-incorporation, you can open a US business bank account, often with partners like Mercury Bank, and activate Stripe payments to accept transactions globally.

This streamlined approach contrasts with traditional methods, which might involve hiring lawyers and navigating state offices, potentially costing more and taking longer.

Cost Structure: Is It Worth the Price?

Stripe Atlas charges a one-time fee of $500, which includes:

- Incorporation in Delaware (either C Corporation or LLC, with LLC support added as a popular update in recent years (Stripe Blog: Atlas for LLCs)).

- Obtaining your EIN.

- First-year registered agent fees (ongoing annual fee is $100 thereafter).

Additional costs users have reported include:

- $20 for mail forwarding.

- $5 for a US phone number.

- $10 for debit card forwarding.

- $6 for form-1583 notarization.

- Optional $50 for CPA consultation.

While the $500 fee is competitive, some users note additional expenses like banking fees, especially with SVB, which charges $25/month with a $25,000 minimum balance (Hacker News Post).

Pros of Using Stripe Atlas

Here’s why many founders find Stripe Atlas appealing:

- Ease of Use: The platform is intuitive, with a guided workflow that takes about an hour to complete, according to some reviews (Headwest Guide).

- Time Savings: By handling paperwork and filings, Atlas saves you from the time-consuming process of DIY incorporation or working with traditional law firms.

- Cost-Effectiveness: Compared to hiring a lawyer, which can cost thousands, the $500 fee is a bargain, especially for early-stage startups.

- Access to US Market: Incorporating in Delaware gives you credibility and access to the US financial system, crucial for attracting investors and customers.

- Payment Processing Integration: Seamless integration with Stripe allows you to accept payments in over 100 currencies, with benefits like one year of free US card payments processing up to $100,000 (Stripe Atlas Official).

- Community and Resources: Access to the Stripe Atlas Community, AWS $5,000 credits, and guides on taxes, equity, and bookkeeping add value (Stripe Guides).

Cons and Potential Drawbacks

However, Stripe Atlas isn’t without its challenges:

- Tax Implications: As a US company, you’re subject to a 21% corporate tax rate (post-2017 TCJA), and non-resident aliens may face double taxation or a 30% withholding tax without a tax treaty (Nomad Capitalist). This can be complex, and Atlas’s basic tax advice from PwC may not suffice for unique situations.

- Legal Risks: Operating a US company, especially a Delaware C Corp, exposes you to higher litigation risks, potentially affecting founders, officers, and employees (Nomad Capitalist).

- Limited to Delaware: Atlas only incorporates in Delaware, which is business-friendly but may not be optimal for all industries or if you plan to operate elsewhere.

- User-Reported Issues: Some users, particularly those with existing Stripe accounts, faced migration headaches, losing startup school discounts and needing to DIY script migrations for subscriptions and coupons (Hacker News Post). Banking with SVB has been criticized for high fees ($25/month, $25,000 minimum balance) and poor tech support.

- Approval Process: Not all businesses qualify; controversial services like tax reduction may be excluded, limiting its applicability (Nomad Capitalist).

User Reviews and Testimonials: A Mixed Bag

User experiences with Stripe Atlas vary widely, reflecting its strengths and weaknesses:

- Positive Experiences:

- A founder from Rapidr, Inc., incorporated as a C-Corp and found the process “phenomenal, mostly painless,” praising world-class support with responses within 24 hours and AWS credits saving thousands (Rapidr.io Blog). They highlighted the ease of setting up a Mercury Bank account and accessing legal templates.

- Another user appreciated the streamlined process, helpful reminders for tax filings, and no dealbreakers despite migration issues, noting it’s ideal for tech startups (Hacker News Post).

- Negative Experiences:

- An OP on Hacker News regretted using Atlas, citing time-consuming account migration (only customers migrated automatically, others required DIY scripting), loss of Stripe startup school discounts, and SVB’s high fees ($25/month, $800/year corp costs, ~$2,000/month payroll taxes) (Hacker News Post). They found switching to alternatives like Azlo complicated due to no international transfers.

- Critics like Nomad Capitalist argue it’s a “bad idea” for online businesses, emphasizing the tax and legal burdens outweigh the convenience for non-Silicon Valley startups (Nomad Capitalist).

Here’s a table summarizing key user feedback:

| Aspect | Positive Feedback | Negative Feedback |

|---|---|---|

| Ease of Process | Streamlined, user-friendly, took hours to complete | Migration issues for existing Stripe users, time-consuming for some |

| Cost | $500 fee seen as cost-effective, AWS credits saved thousands | Additional banking fees (SVB $25/mo, $25k min balance) high, ongoing $100/yr agent |

| Support | World-class, responses within 24 hours, helpful reminders | Limited for complex tax needs, basic PwC advice insufficient |

| Tax and Legal | Guides provided, community access helpful | Complex US tax rules, potential double taxation, high litigation risk |

| Banking | Mercury Bank easy to set up, 3-4 days approval | SVB fees and tech issues, Azlo limited for international transfers |

Alternatives to Stripe Atlas

If Stripe Atlas doesn’t fit your needs, consider these options:

- Traditional Law Firms: Offer personalized advice but can cost thousands, ideal for complex needs.

- Online Incorporation Services: Companies like Incfile, ZenBusiness, and LegalZoom provide competitive pricing, with Incfile often cheaper than Atlas’s $500 fee (Headwest Guide). They support multiple states, not just Delaware.

- DIY Incorporation: Handle filings yourself using state forms, but requires understanding US business law, potentially saving money but time-intensive. Resources like Harvard Business Services ($150 registered agent fee) and Axos Bank were suggested by users (Hacker News Post).

Here’s a comparison table for first-year costs:

| Service | Core Filing | Operating Agreement | EIN | Registered Agent | Total First-Year Cost |

|---|---|---|---|---|---|

| Stripe Atlas | Included | Included | Included | $0 (first year) | $500 |

| Incfile | $0 | $99 | Included | $119 | $218 |

| ZenBusiness | $0 | $99 | Included | $199 | $298 |

Note: Ongoing costs vary, with Atlas requiring $100/year for registered agent services post-first year.

Recent Updates and Community Engagement

Stripe Atlas has evolved, with notable updates including:

- Support for LLCs, added as a response to user demand, offering more flexibility for small teams and side projects (Stripe Blog: Atlas for LLCs).

- Community events like Q&A sessions with Y Combinator’s CFO and private interviews with industry leaders like Sam Altman, enhancing networking opportunities (Stripe Blog Updates).

These updates show Stripe’s commitment to supporting entrepreneurs, but also highlight its focus on tech startups, which may not align with all business types.

Conclusion: Is Stripe Atlas Worth It?

Stripe Atlas is a powerful tool for global entrepreneurs seeking a quick, cost-effective way to incorporate a US company, particularly if you’re building a tech startup and comfortable with Delaware’s business environment. Its ease of use, time savings, and access to Stripe’s payment ecosystem are significant advantages. However, the potential tax implications, legal risks, and user-reported issues like banking fees mean it’s not a one-size-fits-all solution.

When to Use It:

- If you’re a non-US founder targeting the US market, especially for tech or VC-backed startups.

- If you value speed and simplicity over personalized legal advice and are okay with Delaware incorporation.

When to Look Elsewhere:

- If you need incorporation in other states or have complex tax situations, consider alternatives like Incfile or ZenBusiness.

- If you’re concerned about US tax burdens or litigation risks, consult a tax professional before proceeding, as Atlas’s $500 advice may not cover all bases.

Ultimately, weigh the convenience against the long-term costs and risks, and remember: for some, the $500 fee could save thousands in time and effort, while for others, it might open a Pandora’s box of tax and legal challenges.

Leave a Reply