As someone who’s always on the lookout for convenient payment solutions, I recently delved into Klarna, a prominent “buy now, pay later” (BNPL) service that’s been gaining traction worldwide. Founded in 2005, Klarna operates in multiple countries and partners with numerous retailers to offer flexible payment options. In this blog post, I’ll share my personal experience and insights into Klarna’s features, benefits, drawbacks, and overall user experience.

What Is Klarna?

Klarna is a financial technology company that provides shoppers with the ability to split their purchases into manageable payments. It aims to make online shopping more accessible by offering various payment plans that cater to different financial needs.

Key Features

Payment Options

Klarna offers several flexible payment plans:

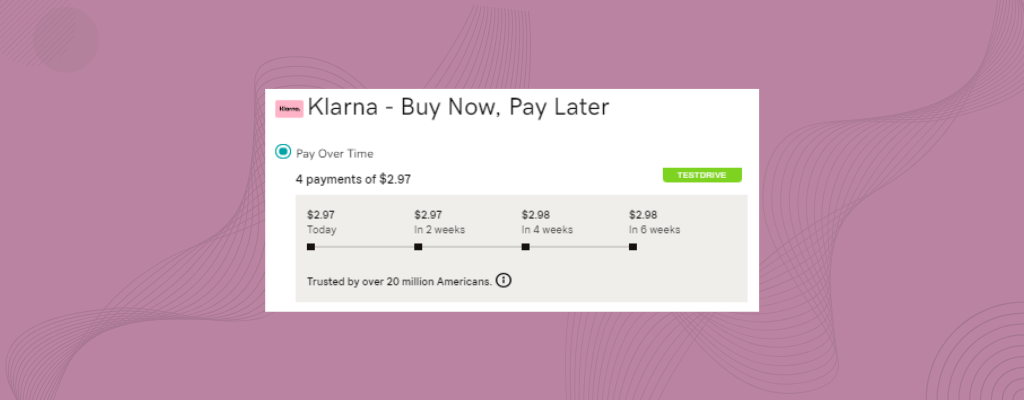

- Pay in 4: Split your purchase into four equal payments, with the first payment due at checkout and the remaining payments every two weeks.

- Pay in 30 Days: Buy products now and pay for them within 30 days, giving you time to try out your purchases before committing financially.

- Monthly Financing: Longer-term financing options ranging from 6 to 24 months. Depending on your eligibility, you might even secure zero-interest financing.

User Experience

One of the standout features is Klarna’s mobile app, which enhances the shopping experience:

- Browse Retailers: Discover and shop from various retailers directly within the app.

- Price Comparisons: Compare prices to ensure you’re getting the best deal.

- Payment Management: Easily track and manage your payments.

- Reminders: Receive notifications for upcoming payments to avoid late fees.

- Rewards Program: Earn discounts at participating retailers through their rewards system.

Instant Approval

Klarna typically conducts a soft credit check for most transactions, which doesn’t impact your credit score. However, for longer financing options, a hard credit check may be required.

Pros and Cons

Pros

- No Interest on Most Plans: Enjoy interest-free payments on short-term plans like Pay in 4 and Pay in 30 Days.

- Instant Financing Approval: Get quick decisions on your financing applications.

- Flexible Payment Options: Choose a payment plan that fits your financial situation.

- User-Friendly App: The app makes shopping and payment management seamless.

- Good Customer Service Feedback: Many users report positive interactions with customer support.

Cons

- Late Fees Can Accumulate Quickly: Missing payments can lead to significant late fees.

- Lack of Transparency in Borrower Requirements: Some users feel unclear about the terms, fees, and credit limits.

- Potential for Overspending: The ease of deferred payments might tempt some to spend beyond their means.

- Billing Issues and Delayed Refunds: There are complaints about billing inaccuracies and slow dispute resolutions.

My Personal Experience with Klarna

The Advantages

I found Klarna’s flexible payment plans incredibly helpful, especially for larger purchases. The ability to spread out payments without incurring interest made budgeting easier. The mobile app is intuitive and offers a smooth user experience. Browsing through different retailers and managing payments all in one place was convenient.

When I had a question about my payment schedule, Klarna’s customer support was responsive and helpful, addressing my concerns promptly.

The Drawbacks

However, I did notice some areas of concern:

- Late Fees: While I didn’t incur any, I was wary of the potential for late fees if I missed a payment. It’s essential to stay on top of the payment schedule to avoid extra charges.

- Transparency: I found some of the terms and conditions a bit vague, particularly regarding eligibility for zero-interest financing and how credit limits are determined.

- Dispute Resolution: While I haven’t personally experienced issues with returns or refunds, I’ve read several user reviews expressing frustration over delayed refunds and difficulties in resolving disputes with merchants.

Is Klarna Right for You?

Klarna can be a great tool if used responsibly. Here are some things to consider:

- Financial Discipline: If you’re confident in your ability to make payments on time, the flexible payment options can be beneficial.

- Understanding Terms: Take the time to read and understand the terms and conditions to avoid any surprises.

- Monitoring Spending: Be mindful of the temptation to overspend simply because payments are deferred.

Final Thoughts

Overall, I believe Klarna offers a compelling service that enhances the shopping experience by making purchases more accessible. The convenience and flexibility are significant advantages, especially for those who prefer not to pay for large purchases all at once.

However, it’s crucial to approach BNPL services like Klarna with caution. Ensure you fully understand the payment plans, stay disciplined with your spending, and keep track of payment due dates to avoid late fees.

Have you tried Klarna or another BNPL service? I’d love to hear about your experiences. Feel free to share your thoughts or ask any questions in the comments below!

Leave a Reply